In 2015, we launched our IvyCamp Platform to help high potential early stage companies to grow, scale and engage with customers. The platform has built a network of over 5000 Alumni as mentors, investors, corporates, accelerators, entrepreneurs to work with these startups. As a next natural step, we have launched this Angel Fund as part of the Platform to invest in some of these select startups.

The Angel fund intends to strengthen the start-up ecosystem by providing access to early stage financing, a high quality mentor network and access to global markets. The aim of the fund is to participate in the cycle of value creation early on and nurture innovative businesses that are addressing large product market gaps and are founded by strong and experienced teams.

The IIT Alumni network spread across the world, the IvyCamp platform, and engagements with the leading educational institutes in India and abroad ensures a high quality deal flow which receives focused mentoring by our team of advisors the world over and strategic value addition from our existing portfolio companies.

Investing in High Quality Entrepreneurs

IITs rank amongst top 4 global universities for VC backed promoters 11 Indian startups achieving billion-dollar valuation founded by IITians

Mentor Program Active Scale-up support

Highly credible team of ~65 Mentors. Designated mentors & access to entire mentor pool for each company

Co-Investment Linkage

22 Institutional Investors as LPs Investors/LPs offer potential access to co-investment capital across various stages

IvyCamp Platform Advantage

India s first Global Entrepreneurship & Innovation platform A marketplace for all stakeholders of the start-up ecosystem

Proprietary & High Quality Deal Flow

The Alumni Network Home bound professionals Over 50% of deals sourced through network Support of over 5,000 alumni

High Quality Governance Structure

Chairman, G.K. Pillai is former Home Secretary of India Board representation from financial institutions & faculty of IIT/IIM

Deep Rooted Network

Senior Partners & Advisors are pioneers in their fields and have served on Govt and RBI committees on capital market regulations

Extended Network Support for Exits

54% of top 500 Indian companies have at least one IIT/IIM graduate on their Board

GK Pillai

IAS Former, Home Secretary, India

Investment Funds

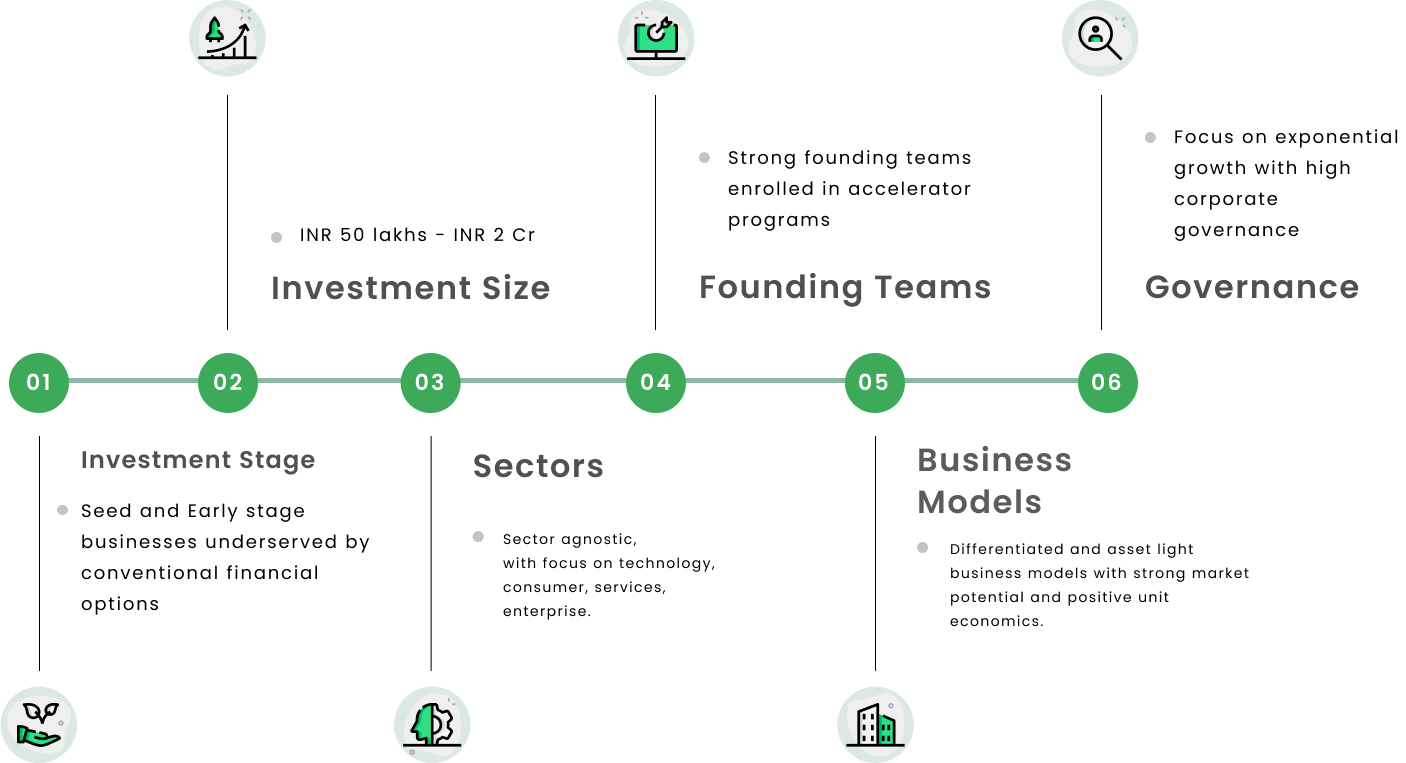

Asset light models and underserved by conventional financing options.

Term

10 years (plus 1*1 extensions) from the data of final closing

Setup Fee - One Time

2% of the total capital commitments

Target Investors

Indvidual Investors, Institutional Investors, Banks, Insurance Companies and Family Offices - subject to critetia under the SEBI (AIF) Regulations

Commitment Period

4 years from the date of final closing

Hurdle Rate

10% per annum for INR Investors

5% per annum for $ investors

Investment Manager

IvyCap Ventures Advisors Private Limited ("IVAPL"). Investor approval required for each investment.

Target IRR

25% p.a ( Fund Level)

Size

INR 60 Cr/ $ 8.57 Million (Including Green-shoe Option of INR 30 Cr./ $ 4.28 Million)

Expected Closings

First Closing at INR 10 Cr

Management Fee &

Carried Interest

|

Management Fee |

Carried Interest |

|

5% p.a. for first two years and 0% p.a. after that |

30 % p.a |