5 Reasons startups need to take up sustainability actively in 2022

by Smita Mishra, Founder and CEO of Fandoro Technologies Pvt Ltd - an IvyCap Ventures Company, January 1, 2022

Discussions about sustainability are fast getting their rightful place in the business world – the center stage. In 2021 we saw tremendous upswing in discussions happening around- ways for businesses to be resilient to handle health pandemics and the resulting economic and social backlash due to it, public statements being made by organizations taking up sustainability goals of going carbon neutral or net zero or reducing water footprint, recharging lakes, zero waste to landfill, significantly shifting the source of power from non-renewables to renewable sources. COP 26 held in Glasgow in November 2021, gave an opportunity to the nations for stock taking on their performance so far and maybe revise their commitments to do more.

-

Changing Business environment

Government regulations across the globe are changing in favor of stricter adoption of sustainable practices across businesses. There are incentives for building sustainable businesses, and clear rules for making it costly forthe businesses that are polluting. With that as the background, and nations gearing up to meet sustainability goals at a faster pace, private businesses are stepping up to play a more active role than in past.

92% of S&P 500 companies and 70% of Russell 1000® Companies Published Sustainability Reports in 2020, G&A Institute Research Shows. As per KPMG in 2021 - 49 percent of CEOs plan to put in place more stringent ESG practices. - India - Mandatory BRSR reporting for top 1000 listed companies

- US – SEC response to Climate and ESG Risks and Opportunities

- UK – Chancellor publishes roadmap setting out details on new Sustainability Disclosure Requirements

- Europe - EU Taxonomy Climate Delegated Act

- Canada – Canada Moves Towards Mandatory Climate Disclosures

- Australia - Mandatory Reporting for Environmental Social Governance Metrics

-

Changing customer preferences

Interest in transparency claims is growing—particularly among younger consumers. The new age consumers are very aware about topics like animal welfare, responsible testing of products, and sustainability in the entire value chain from sourcing to distribution. Consumers are looking for more locally grown produces. Businesses are looking to build trust through good governance and prioritizing sustainability issues. Startups can leverage this drive by customers by supporting organizations in building their local ecosystems and building sustainable products.

-

Money Money

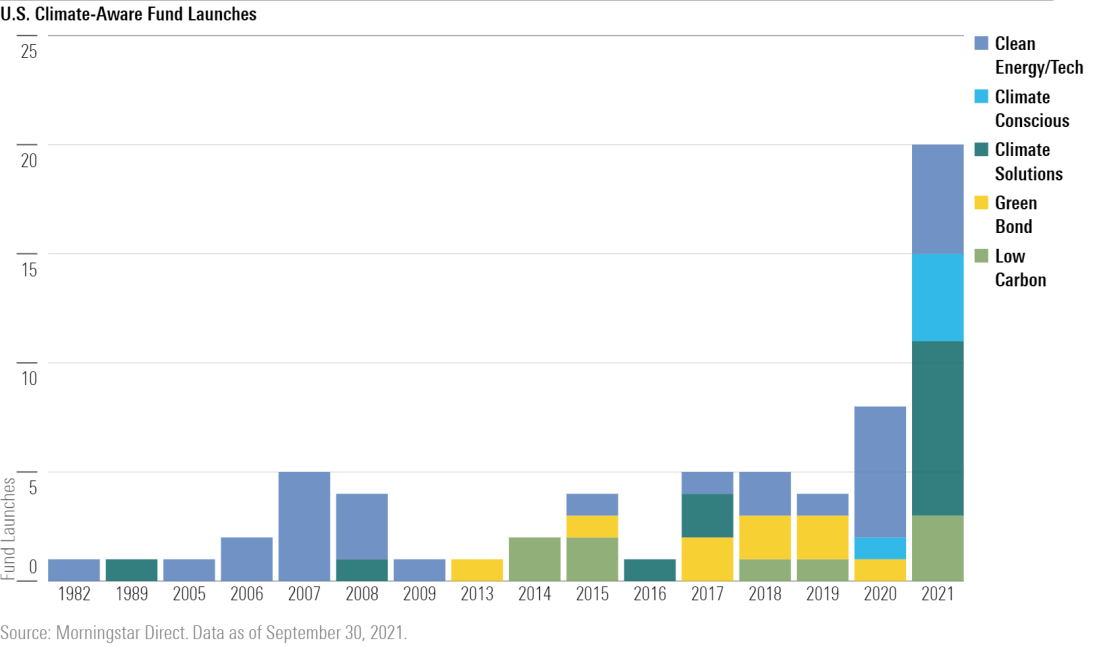

2 aspects of sustainability – building stakeholder engagement and bringing in transparency through disclosures directly add to building a better access to capital. Increasing transparency and accountability builds trust and minimizes risk perception. There are three channels through which sustainability is changing investment: profitability, risk and investor flows. Team Blackrock had shared their perspectives on a framework for incorporating sustainable investing in portfolio construction last year in their whitepaper - Sustainability: The tectonic shift transforming investing.

-

Reduce costs

Sustainability can be used to cut costs in the long term. Most sustainability related actions like - Renewable energy, lower carbon emission, environmentally safe products; better ways to manage waste- require investment in the short run. But considering the regulatory risks and operational risks due to non-sustainable use of resources – and the social license to operate due to customer awareness and growing preferences of sustainable alternatives – the cost doesn’t seem huge in the long run. ustainability can be used to cut costs in the long term. Most sustainability related actions like - Renewable energy, lower carbon emission, environmentally safe products; better ways to manage waste- require investment in the short run. But considering the regulatory risks and operational risks due to non-sustainable use of res ustainability can be used to cut costs in the long term. Most sustainability related actions like - Renewable energy, lower carbon emission, environmentally safe products; better ways to manage waste- require investment in the short run. But considering the regulatory risks and operational risks due to non-sustainable use of res

-

Retain talent

Talent war is for real and it is on. Employees are increasingly preferring companies that demonstrate responsible behavior and a purpose. Organizations actively adopting sustainable development offer a sense of purpose amongst team members and give them an opportunity to make a difference.

Some of the regulatory updates from across the globe coming in 2021 alone –

While it may appear on the face of it that these regulatory requirements are limited to larger enterprises, if you dig deeper on any of the regulations, it will become clearer that the idea is to cover beyond the large organizations. For e.g. in the guidelines for applicability of Business Responsibility Sustainability Report of India, it is mentioned – “A five-year time period may be explored for phasing the implementation to cover all companies gradually.”

The Global Sustainability Study 2021 conducted recently Reveals More Than a Third of Global Consumers Are Willing to Pay More for Sustainability as Demand Grows for Environmentally-Friendly Alternatives. As expectations around sustainability climb, companies are facing significant pressure to prove their sustainability credentials and to make it a central part of their value proposition.

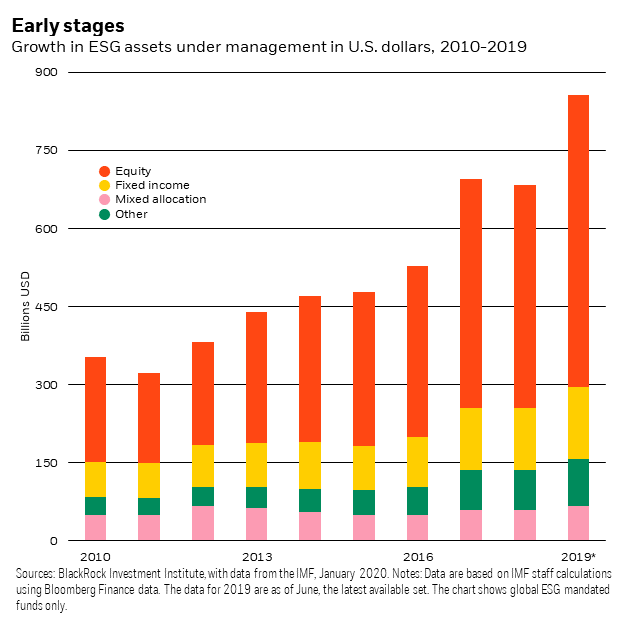

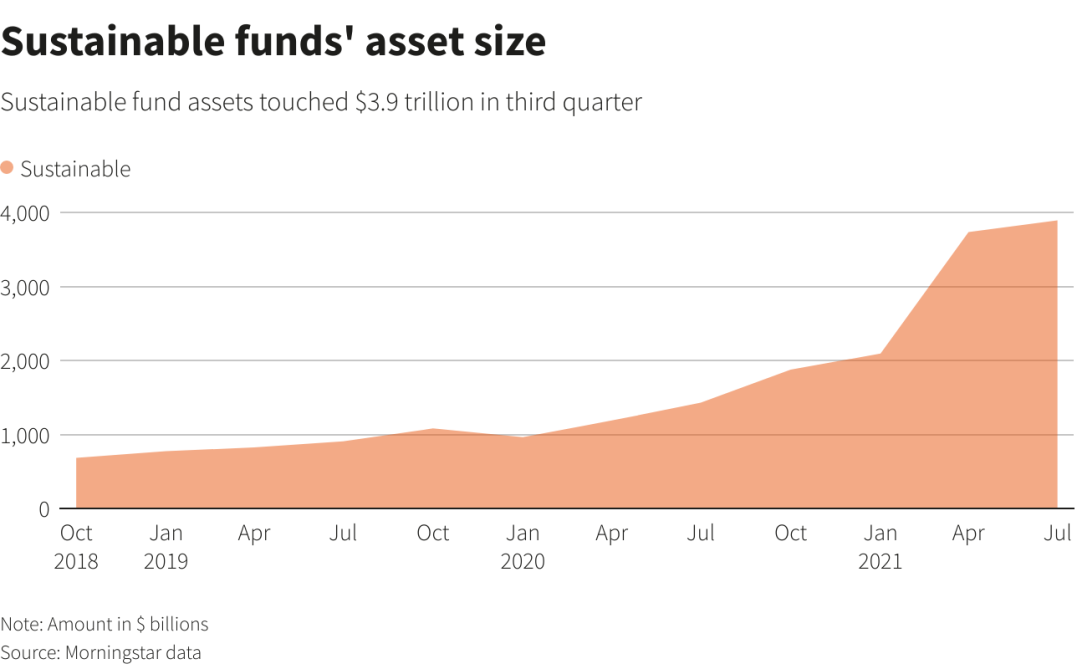

Investors recognize that environmental and social issues pose as risks and also offer opportunities in respect to their investments. And therefore are seeking disclosures on environmental and societal performance of businesses. Globally funds allocated to sustainability have increased significantly to $3.9 trillion in the 3rd quarter of 2021.

Financial incentives like tax credits and financial assistance are accelerating sustainable businesses in the space of renewables replacing fossil fuels.

Startups need to leverage this aspect. But - Sustainability cannot be an afterthought. To be able to truly be sustainable in a way that is economically sustainable – businesses need to “Design for sustainability”. The right way to adopt sustainability to reduce costs is to integrate sustainability in their core values and be driven by it.

For e.g. :By minimizing redundant or conflicting standards in packaging, some firms have saved as much as 11% with harmonization. Small changes like reducing the thickness of carton covering, substituting polystyrene with PET and reducing the size of secondary packaging can reduce material cost, improve recyclability while cutting down expenditure and lower greenhouse emissions. Getting rid of one gram of PVC in a product results in a 3.4 gram reduction in fossil fuels in addition to large savings.

Teams working on common sustainability initiatives, gives a sense of belongingness to the team members and job satisfaction due to having positive impact on the society. A healthy employee engagement plan can be very effective tool in increasing productivity.

A recent IBM Survey says 71% job seekers want to work for environmentally sustainable companies after pandemic. Workers want to feel that their employers are aligned with their values and actively taking action.

Another survey in UK said - almost two-thirds (65%) of our survey respondents said that they were more likely to work for a company with strong environmental policies.

Interestingly more and more employees are expressing the desire to learn moregreen skills so that they can become more valuable in the workplace. As per the survey mentioned above, it was about 63%.

Organizations particularly startups should leverage this to build a more meaningful team with a lower turnover.

About IvyCap

IvyCap Ventures - an early stage Venture Capital firm that nurtures entrepreneurs and their ideas into sustainable businesses, leveraging our Global Alumni Ecosystem.

India’s first VC firm to integrate SDG investing for enhanced returns

At IvyCap, responsible investing entails a wide spectrum of investment strategies and approaches centered on generating returns sustainably. We constantly adopt existing solutions focused on creating lasting value for all our stakeholders - ranging from ESG strategies, exclusions and integration to thematic investing. We are committed to creating impact over and above financial returns. As such, we invest through the SDG Framework - UN’s blueprint to achieve a better and more sustainable future by 2030.

Read MorePREVIOUS POST

Chartering Plan for Clean Air and Clean EnergyNEXT POST

Advent of 5G, Adjacent Innovation and Opportunities (for Start-Ups)Latest Update

-

An Ethic of Responsibility

01-11-2021